ERP for Food Manufacturing

Indian food manufacturers are not losing money in big dramatic ways — they’re losing it quietly.

- 1% recipe variance

- 3% expiry losses

- 2% dispatch delays

- Compliance scrambling before audits

None of these individually look dangerous. But together, they steadily erode margins, lock working capital, and slow growth. These leaks rarely appear clearly in the P&L — but they destroy scale.

Food manufacturing in India has entered a data-driven era. FSSAI traceability expectations are tightening. Raw material costs are volatile. Distributors expect faster order commitments and expiry-sensitive dispatch. Export buyers increasingly demand documentation and batch visibility.

Yet inside many factories, operations still rely on:

- Excel-based batch logs

- Tally or basic accounting tools

- WhatsApp production coordination

- Manual QC registers and paper trails

This setup can function at ₹3–5Cr turnover. But once:

- SKU count grows

- Batch sizes vary frequently

- Distributor networks expand

- Compliance audits increase

The system begins to crack. Decisions slow down. Errors multiply. Financial visibility becomes reactive instead of real-time.

This guide explains how ERP for food manufacturing in India actually works, what features matter, how much it costs, when to implement, and how CEOs can avoid expensive mistakes.

Not a software brochure.

A strategic decision framework for scaling safely.

Why Food Manufacturing in India Needs ERP in 2026

Regulatory Pressure is Rising

FSSAI requirements are increasingly focused on traceability and documentation. It’s no longer enough to maintain registers. Manufacturers must be able to answer quickly:

- Which raw material batch went into this finished product?

- Which customers received this batch?

- What QC results were recorded?

Compliance Scenario

A distributor reports contamination suspicion. Without structured traceability, your team spends 2–3 days digging through registers, WhatsApp chats, and Excel sheets. Production halts, reputation suffers, and legal risk escalates.

With ERP, the same question becomes a 5-minute report.

Distribution Expectations have Changed

Modern distributors expect:

- Faster order confirmation

- Batch-level stock commitment

- Expiry-aware dispatch

If warehouse data isn’t real-time, sales teams overpromise. This leads to:

- Partial dispatches

- Emergency production runs

- Freight premium costs

ERP synchronizes stock, batches, and orders — reducing chaos at dispatch.

Manual Systems create Invisible Financial Leakage

Fragmented systems lead to:

- Production quantities not matching accounting entries

- Delayed costing updates after raw material price changes

- Planning based on guesswork instead of demand signals

Typical Mid-Size Factory Chaos Snapshot

- Accounts shows profit

- Warehouse shows excess stock

- Production claims shortage

- Sales promises deliveries that inventory cannot support

ERP doesn’t just automate — it creates single-version operational truth.

The Hidden Margin Leaks that Most Food Manufacturers Don’t Track

Recipe Variance Leakage

Suppose your standard recipe requires 10 kg sugar per batch. Actual usage averages 10.5 kg.

That’s 0.5 kg extra per batch.

- 400 batches/month = 200 kg excess

- ₹45/kg sugar = ₹9,000/month

- ₹1,08,000/year from sugar alone

Multiply across ingredients and plants — easily 1–2% revenue leakage.

ERP records actual consumption per batch and flags variance trends.

Expiry-Driven Inventory Write-Offs

Slow-moving SKUs often sit unnoticed because:

- Warehouse data is static

- Expiry is tracked manually

- Sales teams don’t see aging stock

ERP enables FEFO dispatch and aging alerts, reducing expiry losses significantly.

Production Downtime Cost

Unplanned downtime often comes from:

- Raw material shortages discovered late

- Scheduling conflicts between machines

- Delayed QC approvals

Even 30 minutes/day downtime in a ₹20Cr plant can cost lakhs annually in lost output and overtime.

ERP-driven production planning anticipates these gaps.

Compliance Panic Costs

Without structured records, audits require:

- Reconstructing batch history manually

- Assigning staff to document gathering

- Halting production for verification

These hidden labour costs and disruption rarely get accounted for — but they compound.

Example

A ₹20Cr plant losing:

- 1.5% recipe variance

- 2% expiry loss

- 1% downtime cost

= ₹1.2Cr annual silent erosion

What ERP for Food Manufacturing Actually Does

Batch-Level Inventory Tracking

ERP links:

- Inward raw material batches

- Production consumption batches

- Finished goods batches

- Dispatch history

This ensures recall readiness and traceability.

Recipe & BOM Standardization

ERP maintains:

- Approved recipe versions

- Yield expectations

- Cost per batch automatically updated

If ingredient prices change, costing updates instantly — improving pricing decisions.

Expiry-Aware Stock Management

ERP supports:

- FEFO dispatch logic

- Automatic expiry alerts

- Warehouse aging analysis

This protects working capital and reduces write-offs.

Production Planning Automation

ERP converts:

- Confirmed sales orders

- Forecast demand

into material requirements and production schedules.

This reduces emergency procurement and overtime.

Quality Control Integration

QC checkpoints can be enforced:

- Raw material inspection

- In-process checks

- Finished goods approval

Test reports remain linked to batches — critical for audits and exports.

When Should a Food Manufacturer Implement ERP?

Below ₹5Cr

Manual systems can still function if:

- SKU count is small

- Operations centralized

- Compliance simple

ERP here is optional.

₹7–10Cr Stage → Early Warning Zone

Signs:

- Increasing distributor credit tracking issues

- Difficulty knowing exact stock by batch

- Pricing decisions delayed due to unclear costing

ERP becomes a Strategic Preparation Tool here.

₹15–20Cr Stage → ERP Becomes Urgent

At this level:

- Multi-warehouse coordination starts

- Audit complexity rises

- Planning inefficiencies cost real money

Delaying ERP now increases future implementation complexity.

₹30Cr+ Stage → ERP Delay Becomes Expensive

At scale:

- Operational chaos multiplies

- Data cleanup becomes massive

- Employee resistance grows

ERP adoption becomes not just useful — but necessary for stability.

Decision Checklist

If 3+ of these apply, ERP discussion is overdue:

- Frequent stock mismatches

- Expiry write-offs

- Delayed costing updates

- Compliance anxiety

- Planning based on intuition

ERP vs Accounting Software vs Excel

| Capability | Excel | Accounting Software | ERP |

| Batch traceability | Manual | Limited | Full automated |

| Expiry management | Manual | None | Built-in alerts |

| Production planning | No | No | Demand-driven |

| Costing accuracy | Approx | Partial | Real-time |

| Compliance readiness | Weak | Weak | Strong |

| Scalability | Poor | Medium | High |

Scenario

Excel can manage stock counts.

Accounting software manages finance.

ERP connects operations + finance + compliance + planning.

Cost of ERP for Food Manufacturing in India

Software Cost Ranges

- Open-source ERP: lower license cost, higher customization planning

- Mid-tier ERP: subscription-based, moderate flexibility

- Enterprise ERP: high cost, complex implementation

Implementation Cost Components

- Process mapping

- Data migration

- Customization for recipes/QC

- Staff training

- Go-live support

For many Indian SMEs, total investment spans ₹6L–₹35L, depending on complexity.

ROI Logic

Savings often come from:

- 1–3% wastage reduction

- Improved working capital from expiry control

- Manpower reduction in reporting

- Faster dispatch cycles

ERP often pays back within 12–24 months if implemented properly.

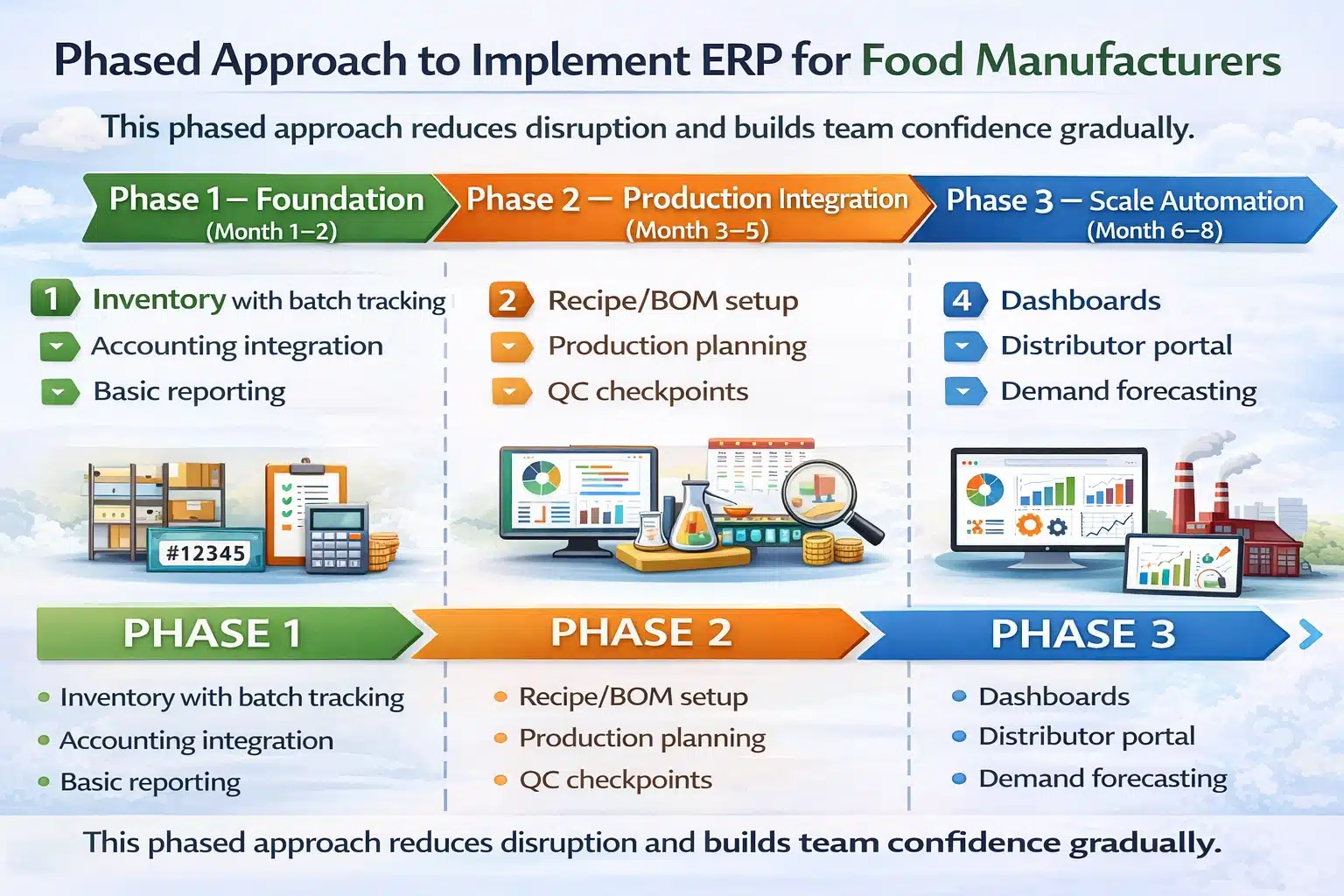

ERP Implementation Roadmap for Food Manufacturers

Phase 1 — Foundation (Month 1–2)

- Inventory with batch tracking

- Accounting integration

- Basic reporting

Phase 2 — Production Integration (Month 3–5)

- Recipe/BOM setup

- Production planning

- QC checkpoints

Phase 3 — Scale Automation (Month 6–8)

- Dashboards

- Distributor portal

- Demand forecasting

This phased approach reduces disruption and builds team confidence gradually.

Mistakes Food Manufacturers Make While Choosing ERP

- Choosing brand popularity instead of process fit

- Expecting ERP to fix bad processes instantly

- Ignoring master data cleanup before implementation

- Underestimating staff training time

- Trying to implement everything at once

Real Failure Scenario

A ₹18Cr snacks manufacturer implemented ERP across all modules simultaneously. Team confusion led to parallel Excel usage for months, delaying ROI and increasing frustration.

ERP success depends more on Implementation Strategy than software brand.

How to Evaluate the Right Food Manufacturing ERP Software in India

Checklist:

- Does it support full batch traceability end-to-end?

- Can expiry-based dispatch rules be configured?

- Are recipe costing updates automatic?

- Does it generate audit-ready compliance reports?

- Does the implementation partner understand Indian food manufacturing workflows?

Conclusion

Food manufacturing complexity today is operational, not just financial. Traceability, compliance, working capital efficiency, and planning discipline define scalable factories.

ERP is no longer a luxury IT upgrade. It is an operational control system.

Manufacturers who implement ERP early gain structured growth and predictable margins. Those who delay often implement under pressure — when problems are already costly.

If you want clarity on whether ERP makes sense for your factory now, the smartest next step is not buying software — it’s understanding your operational readiness.